Agentic AI in Banking: Unlocking Autonomous Intelligence for the Financial Sector

Continuation of our series on Agentic AI

Artificial intelligence (AI) has already reshaped financial services through automation, chatbots, and predictive analytics. However, a new frontier—agentic AI—is redefining banking by introducing autonomous, goal-directed intelligence capable of decision-making with minimal human intervention. Unlike rule-based systems, agentic AI systems adapt dynamically to new information, execute complex tasks in real time, and continuously learn from their environment.

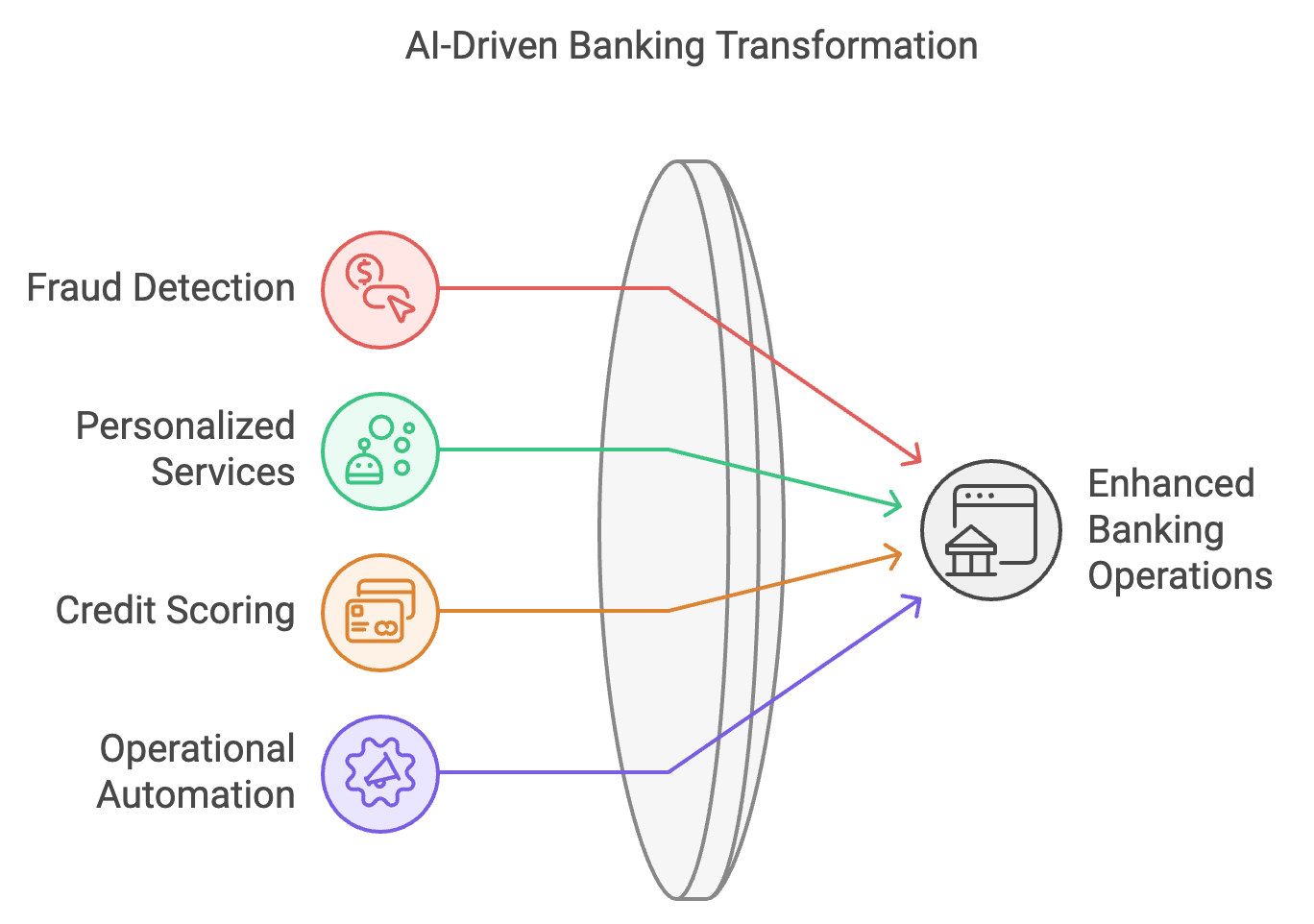

This article provides an in-depth exploration of agentic AI’s technical applications in banking, covering multi-agent fraud detection models, personalized financial assistance, and autonomous risk management frameworks. For banks looking to stay ahead of the curve, agentic AI represents a scalable solution that not only automates tasks but also optimizes business operations through intelligent autonomy.

Agentic AI: A Technical Overview

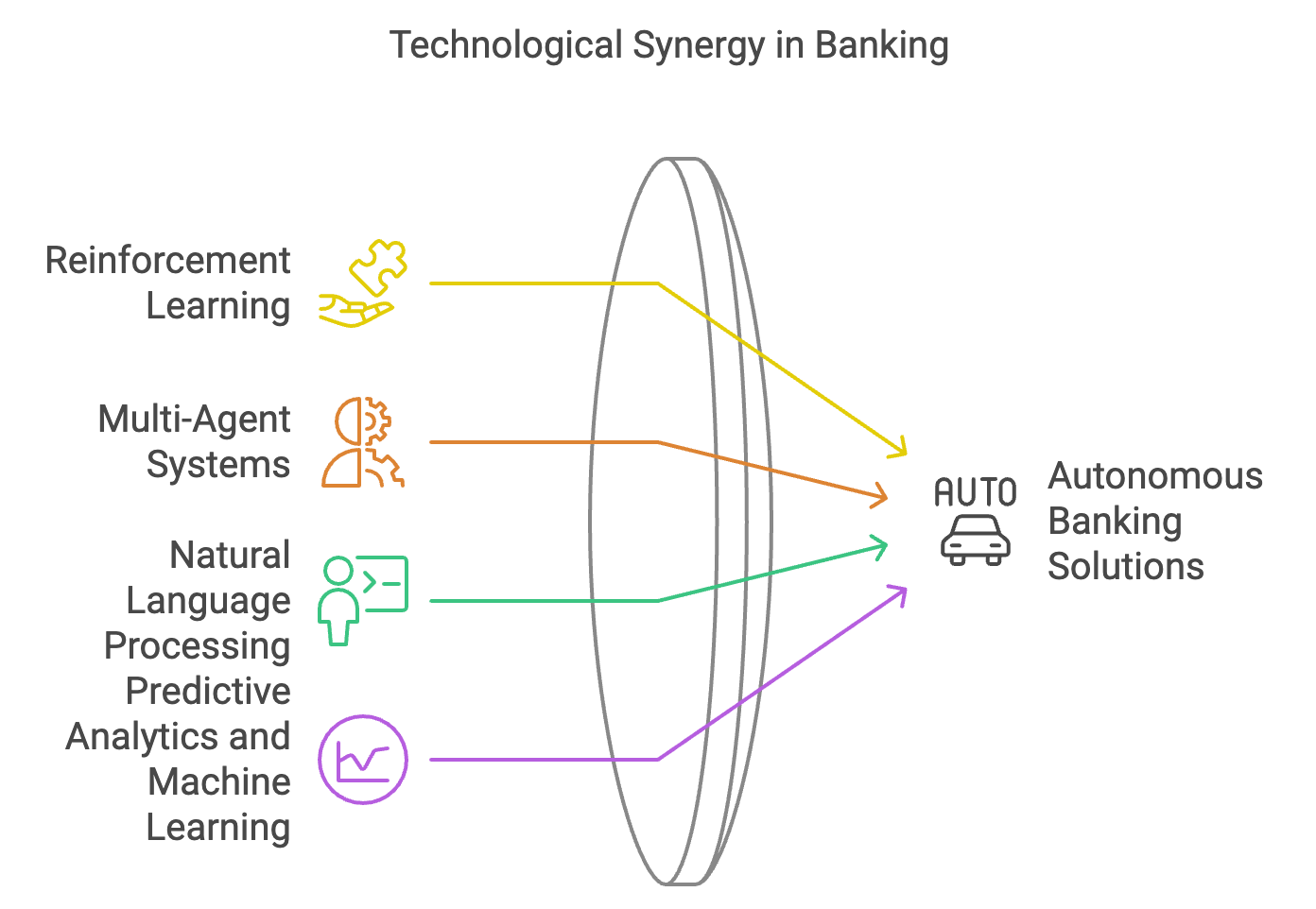

Agentic AI combines several advanced technologies to achieve autonomy:

Reinforcement Learning (RL): AI agents learn optimal strategies through trial and error, refining their decisions over time.

Multi-Agent Systems: These systems involve multiple AI agents interacting to solve complex problems collaboratively or competitively, such as fraud detection.

Natural Language Processing (NLP): NLP allows AI-powered financial assistants to interpret and respond to customer inquiries conversationally.

Predictive Analytics and Machine Learning (ML): Predictive models forecast outcomes, such as loan defaults or market volatility, using historical and real-time data.

In banking, agentic AI serves as the engine for fraud detection, credit scoring, customer service automation, and operational efficiency, offering a level of autonomy far beyond traditional automation systems.

Key Applications of Agentic AI in Banking

1. Multi-Agent Systems for Advanced Fraud Detection

Traditional fraud detection systems rely on rules-based algorithms that monitor transaction patterns against predefined criteria. However, modern fraud schemes evolve rapidly, requiring adaptive intelligence to counter them. Multi-agent systems in fraud detection operate by:

Deploying multiple specialized agents that monitor transactions across various channels.

Coordinating responses to suspicious activity, such as freezing accounts or flagging high-risk transactions.

Sharing insights with human analysts, allowing for faster, more accurate decision-making.

Example: A global payment provider implemented a multi-agent fraud detection system that reduced false positives by 30%, minimizing disruptions for legitimate customers while enhancing fraud prevention.

2. AI-Driven Customer Assistants and Personalized Financial Services

Agentic AI elevates customer service through intelligent financial assistants that provide personalized advice based on real-time data. These systems use NLP models and predictive analytics to:

Offer customized savings plans, investment strategies, and spending recommendations.

Handle loan applications, account management, and customer inquiries autonomously.

Continuously learn from user interactions, refining advice to align with customer goals.

Example: A European bank integrated an AI assistant into its mobile app, providing personalized investment advice. Over 40% of users reported increased engagement with their financial portfolios, highlighting the impact of personalized, autonomous support.

3. Predictive Credit Scoring and Risk Management

In traditional credit scoring models, customer creditworthiness is assessed based on historical data. However, agentic AI introduces real-time, adaptive scoring models that update continuously based on changing borrower behavior. Key features include:

Dynamic Credit Scores: Real-time transaction data influences credit decisions, ensuring that loan approvals reflect the latest financial activities.

Risk Optimization Models: AI agents evaluate borrower behavior and market conditions to optimize lending portfolios and reduce default risks.

Autonomous Loan Processing: AI systems pre-approve loans and set customized terms based on evolving borrower profiles without human involvement.

4. Operational Optimization through Autonomous Decision-Making

Predictive analytics platforms powered by agentic AI enable banks to:

Forecast peak transaction periods and adjust staffing levels accordingly.

Optimize liquidity management by autonomously shifting funds across accounts.

Automate compliance checks to meet regulatory requirements without manual oversight.

Example: A major bank implemented an AI-based liquidity optimization system, achieving a 15% improvement in capital allocation and reducing operational risks during volatile market conditions.

Challenges in Implementing Agentic AI in Banking

While agentic AI offers immense potential, several challenges must be addressed to ensure seamless integration:

Trust and Accountability: AI systems must be transparent to ensure both customers and regulators trust their decisions. Explainable AI (XAI) tools are essential to help stakeholders understand how decisions are made.

Regulatory Compliance: Agentic AI must comply with strict financial regulations, such as GDPR and AI transparency laws, to ensure data privacy and fairness in decision-making.

Model Interpretability and Governance: Complex agentic AI models require continuous monitoring and auditing to prevent unintended outcomes, such as bias in loan approvals or compliance errors.

The Role of Agentic AI in Sustainable Banking

With the growing focus on environmental responsibility, agentic AI also helps banks manage their carbon footprints. Autonomous systems optimize energy consumption in data centers and align credit portfolios with sustainability frameworks, balancing operational efficiency with environmental goals.

How INTELLIGENT CORE™ Delivers Agentic AI Solutions for Banks

At INTELLIGENT CORE™, we provide state-of-the-art AI solutions that empower banks to:

Enhance fraud detection with multi-agent AI frameworks.

Deliver personalized financial services through intelligent customer assistants.

Optimize credit scoring with dynamic, adaptive models.

Automate operational processes with predictive analytics and autonomous decision-making.

Our solutions are designed to meet the specific needs of the financial sector, offering scalability, security, and compliance with regulatory standards.

Transform Your Bank with

Banks embracing agentic AI gain a competitive edge through increased efficiency, better customer experiences, and smarter risk management. Don’t get left behind—discover how INTELLIGENT CORE™ can help your financial institution unlock the power of agentic AI.

📲 Read our full blog article for more insights: https://intelligentcore.io/blog-intelligent-core/ai-banking-industry

References

Chan, A., et al. (2023). Harms from Increasingly Agentic Algorithmic Systems. ACM FAccT Conference.

Schreibelmayr, S., et al. (2023). First Impressions of a Financial AI Assistant: Differences between High Trust and Low Trust Users. Frontiers in AI.

Sepanosian, T., et al. (2024). Scaling AI Adoption in Finance: A Modeling Framework. University of Twente.

Tkachenko, N. (2024). Integrating AI’s Carbon Footprint into Risk Management Frameworks in Banking.

Lee, J.-C., et al. (2023). Understanding Continuance Intention of AI-Enabled Mobile Banking Applications.